I changed my asset allocation to be more conservative: 19%.I did nothing and waited for the market to recover: 54%.Which of these statements best describes your response to the bear market early in 2020?# What is the current asset allocation for your investment portfolio or retirement accounts? The respondents were equally divided between men and women. The median amount saved for retirement among all of the respondents was $188,800. The poll, conducted in early November, surveyed a national sampling of 744 people ages 40 to 74, none of whom were fully retired, who had at least $50,000 in retirement savings. How worried are you about recent stock market volatility? My plan hasn’t changed I will keep doing what I’m doing: 34%.

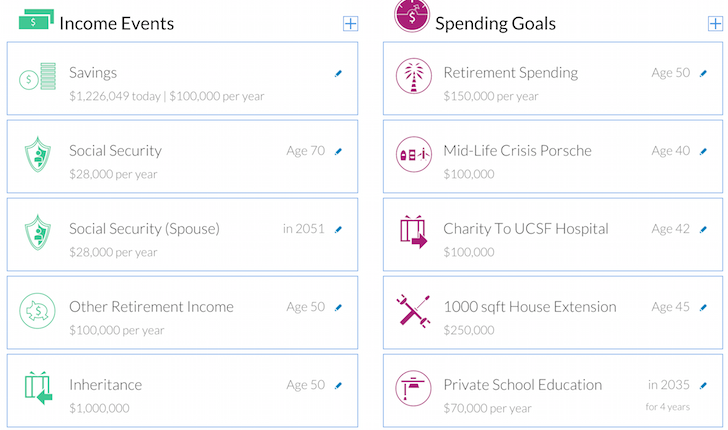

#Personal capital savings planner professional#

I decided to hire a professional adviser: 7%.I will claim Social Security benefits earlier than I originally planned: 8%.I changed my retirement financial projections: 12%.

0 kommentar(er)

0 kommentar(er)